Được thành lập từ năm 1987

Nằm trên diện tích 7.200m²

Chất lượng hàng đầu tại Việt Nam

Đạt tiêu chuẩn sản xuất theo quy định

Về chúng tôi

Công ty TRÁCH NHIỆM HỮU HẠN

Sản xuất & Thương mại Bảo Mã

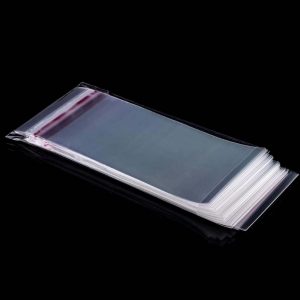

Tiền thân từ Cơ sở bao bì Vĩnh Đạt được thành lập vào năm 1987, đến nay Công ty Bảo Mã được khách hàng tín nhiệm đánh giá như một trong những công ty hàng đầu tại Việt Nam chuyên nghiệp về lĩnh vực sản xuất bao bì nhựa.

Với bề dày hoạt động của mình, Công ty Bảo Mã đã đúc kết nhiều kinh nghiệm quý báu trong việc sản xuất các sản phẩm bao bì nhựa. Hiện tại, công ty Bảo Mã đang áp dụng ISO 9001 – 2015 về hệ thống quản lý chất lượng sản phẩm, đa dạng về chủng loại và kích cỡ đảm bảo kỹ thuật và chất lượng nhằm đáp ứng được sự hài lòng của khách hàng.

English

English